What Is a Real World Asset in Crypto?

Real World Assets (“RWAs”) are assets that exist off-chain, but are tokenized and brought on-chain to be used within DeFi. To bring real world assets into DeFi, the value of an asset must be tokenized” – a process of converting something of monetary value into a digital token so that its value can be represented and transacted on the blockchain. RWAs are, in this way, simply tokens representing the value of a real world asset, which is brought on-chain so that it can be utilized on a DeFi protocol.

Any real world asset that has a well-defined monetary value can be represented by RWAs. RWAs can represent tangible assets, such as gold and real estate, as well as intangible assets, such as government bonds or carbon credits. Below includes a non-exhaustive list of real world asset classes that can be brought onto the blockchain through the RWA vehicle.

Current Use Cases

The main use case that current RWA protocols allow is the collateralization of these assets to obtain loans denominated in cryptocurrencies, normally stablecoins. These protocols evaluate the collateral presented by the borrowers and according to that evaluation they calculate the total amount of the loan. The debt backed up by the collateral is usually converted into an NFT divided into a certain number of tokens that will represent the stake of the lenders, who will exchange that token for stablecoins that will end up in the hands of the borrower. This way, the loan between both parties becomes effective. All the available tokens, as well as the operative liquidity are pooled up in a debt pool which works as a liquidity pool and is managed by the issuer (the borrower). The swaps triggered by the lenders happen within this pool.

Lenders can normally choose between buying two types of token, the senior or the junior tranchee. This categorization is common in debt markets and can be roughly simplified in that junior tranchees bear the most risk (they are the last to be paid, hence they usually receive a higher yield) while the senior tranche is the safest since it is the first to be repaid, hence lower yield. The reality is a little more complex than this, since depending on the situation of the debt pool and the parameters established by the issuer, this situation can change.Once the loan matures, the NFT is repaid by the issuer of the pool and the lenders receive back the principal plus the interests, effectively converting the tokens they hold to stablecoins. These tokens are interest bearing, meaning that the interests paid by the borrower are added to the token holded by the lender.

The range of firms using RWA protocols to raise capital is quite wide, from real estate companies to invoice factoring. However, as supply chain is an industry extremely cash-strapped, shipping or freight invoicing are one of the industries that prefer the use of RWA protocols mostly. RWA let these companies free up working capital by financing the account receivables or invoices that are waiting to be paid.

Supply chain financing normally falls into the hands of the trade finance arm of banks, but not all companies have access to these services that generate fees and interest that can be high for many. On top of that, the control of debt instruments always falls on the banking side, on the contrary, it is the issuers of the pools (borrowers) who set the conditions in RWA protocols. That flexibility, speed of raising funds powered by blockchain as well as a lower cost are the biggest advantage over trade finance.

Analyzing RWA in DeFi: How Can It Be Used to Generate Yields?

RWA use in DeFi can generate yields by leveraging the benefits of both traditional finance and crypto. By tokenizing physical assets and bringing them on-chain, RWA in DeFi can offer:

Sustainable and diversified sources of yield: Investing in real-world assets through DeFi can offer stable and predictable returns, as cash flows and collateral from sources like interest payments on loans or dividends from stocks back these assets. RWAs in DeFi can also be used to diversify portfolios by providing exposure to different asset classes and markets that aren’t correlated with cryptocurrencies, thus helping to balance risk-return profiles.

New opportunities for investment and innovation: DeFi’s use of RWAs has the potential to unlock fresh value and open up new markets for physical assets that traditional finance often neglects, such as niche collectibles, social impact projects or emerging markets. RWA tokenization in DeFi offers new and exciting ways for people to interact with their physical assets, including community building, personalization and even gamification.

Depending upon the asset and platform type, there are different ways to use the RWA concept in DeFi to generate yields. Some of the common methods are as follows.

Lending and borrowing: RWAs can serve as collateral or debt instruments on lending platforms. These platforms allow users to borrow or lend crypto (or fiat currencies) at variable or fixed interest rates. Users can deposit their tokenized real estate or gold as collateral, and borrow stablecoins. Alternatively, a user can lend their stablecoins to a borrower through a tokenized loan backed by a business or car.

Trading and investing: You can use RWA as a trading or investing tool on exchange platforms that permit purchasing or selling crypto or fiat currencies at current market rates. For instance, you can buy or sell tokenized stocks or bonds on a decentralized exchange (DEX). You can also invest in a tokenized fund or index that follows the performance of a collection of RWAs.

Staking and farming: RWA in DeFi can be used for staking or farming instruments on reward platforms that allow users to earn additional tokens or fees by locking up their tokens for a while, or providing liquidity to a pool. For example, users can stake their tokenized carbon credits or art on a governance platform and earn governance tokens or voting rights. Alternatively, users can farm their tokenized U.S. Treasury bonds or commodities on a yield platform and earn yield tokens or transaction fees.

The Limitations of RWA

However, RWA use in crypto also faces challenges and constraints that must be addressed to achieve their full potential.

Regulatory uncertainty and compliance issues: The laws and regulations governing RWAs vary based on asset type, location, jurisdiction, and platform and network used for tokenization. Unfortunately, these regulations may not be clear or consistent with each other, resulting in legal ambiguity and complexity. They can also change over time or differ across regions.

Legal enforceability and security issues: Legal and technical measures must be in place to ensure that token ownership rights are valid, secure and enforceable in both digital and physical contexts. This necessity requires a well-defined legal framework that outlines how ownership rights are transferred, enforced and revoked in cases of disputes or fraud. It also entails a reliable mechanism that connects the digital token to the physical asset, such as a barcode or smart lock. However, executing and maintaining these solutions can be tough, leading to legal and technical risks for RWAs.

Scalability and trust issues: RWA’s success depends upon the reliability and scalability of the platforms and networks that enable tokenization. There must be ample capacity, speed and security to manage the complexity, volume and variety of transactions and data involved. Besides, trust and reputation are critical among all parties involved in the tokenization process, including the asset platform and network, originator, custodian and auditor, to ensure that the RWAs are accurately represented, fairly priced and securely transferred. These challenges could be difficult to resolve or verify, resulting in scalability obstacles and trust issues.

Top 5 RWA Projects in 2023

There are multiple RWA projects in DeFi with distinct visions, strategies and niches. Following are the top RWA projects in 2023 to keep an eye on.

MakerDAO

MakerDAO is a collateralized debt platform on Ethereum that has arguably made the most progress in terms of RWA adoption.

MakerDAO allows borrowers to deposit collateral assets into “vaults” so that they can take out debt denominated in the protocol’s native US$-based stablecoin, DAI. Vaults are simply smart contracts, which hold the borrower’s Ethereum-based collateral until all the borrowed DAI is returned. As long as the value of the collateral remains above a specific threshold, the borrower will have complete control over their collateral. However, if the value of the collateral drops to become undercollateralized, the vaults will automatically liquidate the collateral through an auction process, so that the loan can be repaid in a trustless manner.

Centrifuge

The Centrifuge protocol allows asset originators to obtain liquidity from DeFi by tokenizing their RWAs, such as mortgages, invoices or royalties. This capability is achieved through a two-token system: Tin tokens represent safe, low-return investments, while Drop tokens represent higher-risk, higher-return investments. Users can invest in these tokens using stablecoins such as Dai or USDC and earn interest from the underlying cash flows. Centrifuge’s native token, CFG, is for governance and rewards.

Maple Finance

Maple is a reliable platform that offers cryptocurrency and RWA lending pools. It allows crypto funds and market makers to borrow capital from lenders, who deposit stablecoins into lending pools. Fintech companies and SMEs can use Maple to tokenize their RWAs and use them as collateral to borrow stablecoins from the lending pools. Each lending pool is managed by a pool delegate responsible for underwriting, servicing and monitoring the loans. Maple’s native token, MPL, is used for governance and rewards.

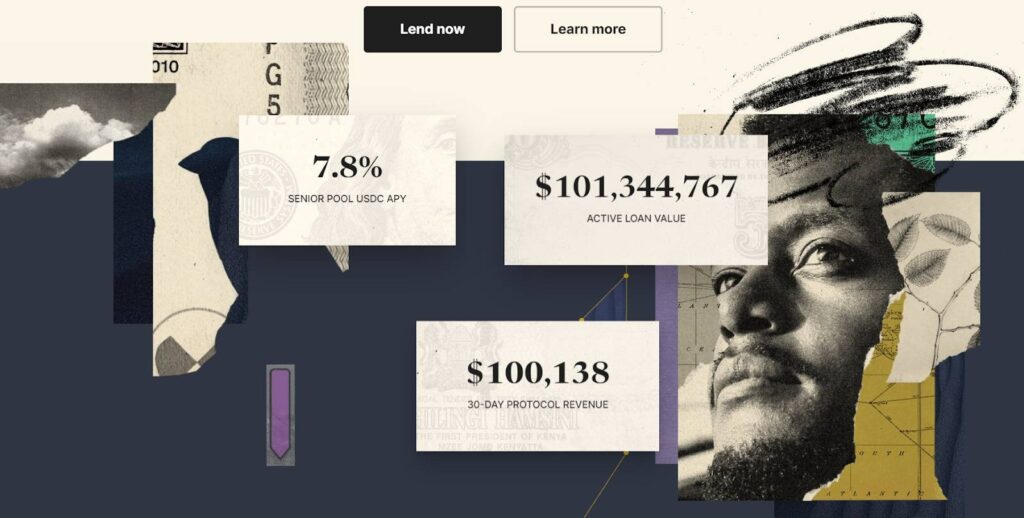

Goldfinch

Goldfinch is a credit platform that operates without intermediaries or collateral, enabling anyone to lend to emerging markets. It follows a three-tiered model in which Borrower Pools, consisting of applicants seeking loans, are backed by lenders or backers who provide capital. Auditors, who are experts in credit analysis, assess the creditworthiness of the Borrower Pools. Goldfinch users can earn interest by lending to Borrower Pools that offer RWA-backed loans. The credit protocol’s native token is GFI.

Creditcoin

Creditcoin is a platform that facilitates connections between lenders and borrowers from different blockchains and asset classes. With Creditcoin, users can lend or borrow any tokenized asset, such as cryptocurrency, fiat, stocks, bonds or RWAs. The system operates on smart contracts that automatically match lenders and borrowers based on their preferences and risk profiles. Its native token is CTC.

What’s Next for RWA Tokenization?

RWA tokenization is poised for significant growth and adoption in the coming years, presenting new opportunities for yield generation, risk management and innovation. This trend is expected to extend to financial instruments such as corporate bonds, equities and derivatives, resulting in faster settlement times, reduced costs and increased liquidity for these markets. Matrixport, a digital asset platform, has already launched tokenized short-term treasury bills (STBT) on the Ethereum and Stellar blockchains, providing investors with access to risk-free rates without the complications of traditional trade execution and settlement.

Physical assets also offer opportunities. MakerDAO, a decentralized lending protocol, has partnered with Huntingdon Valley Bank (HVB) to use commercial real estate properties as collateral for crypto-native protocols.

Increased integration and interoperability between RWA tokens and DeFi protocols will enable RWA token holders to utilize their assets in various DeFi strategies, including lending, borrowing, swapping and staking. The Monetary Authority of Singapore has already launched a pilot program called Project Guardian, which involves tokenizing bonds and deposits that can be used in permissioned liquidity pools on Polygon.

Platforms and projects facilitating RWA tokens’ creation, issuance and management will drive further innovation and experimentation in this area, reducing entry barriers and encouraging diverse stakeholders to participate.

Polkastarter is an example of such a platform, providing a decentralized launchpad that offers cross-chain token pools and auctions.

Prospects

If this vision is true, where do we need to focus to find investment opportunities? In my opinion, first we need platforms or protocols that support encoding RWA into Tokens, then we will need protocols that support the circulation needs of RWA Tokens such as DEX, Lending, CDP, Farming,… Or are protocols that directly accept RWA assets as collateral for loans.

Or a niche that projects can target is bringing Web 3 users access to RWA. Helps investors diversify their investment portfolio.

To carry out these plans, Crypto must have specific assessments of the products in RWA. And RWA assets must have good liquidity to facilitate liquidation. This issue requires a third party with expertise to perform.

Of course, the process of transferring assets between the real world and Blockchain will have a delay. This is one of the biggest risks in applying Blockchain to RWA. Any dApp or platform that can provide good support or solutions to this problem will have the opportunity to grow.

Summary

Including RWA into Blockchian is an inevitable need, it not only brings many benefits to the cryptocurrency market but it also helps the traditional market develop. In the early stages, this segment is still in its infancy and the problem has not been resolved. But until it’s full product, user adoption will be a huge boom for Crypto.