Trend-following investing is one method that can bring investors significant profits. So, what outstanding trends will there be in the cryptocurrency market in Q4 of this year?

Factors affecting trends in the crypto market

- Economic conditions: Such as inflation, interest rates and unemployment, can influence investment trends in the cryptocurrency market. For example, if inflation is high, investors will be more inclined to invest in cryptocurrencies to hedge against inflation.

- Government regulation: Government regulations can have a significant impact on the cryptocurrency market. For example, when the Chinese government banned cryptocurrency trading and mining, DEX and DeFi tokens increased sharply.

- Technological developments: Improvements in blockchain technology or the development of new cryptocurrencies can influence the crypto market. For example: The Layer 1 projects with the vision of replacing Ethereum during the bull run 2020-2021 has created a strong growth trend for coins in this group.

- Media: Media in the cryptocurrency market can also significantly impact investment trends. For example: Billionaire Elon Musk’s tweets during 2020-2021 have brought positive price effects to tokens of meme coin projects such as DOGE, SHIBA…

Top 4 crypto trends that can lead the market in Q4/2023

LSDfi

LSDfi (Liquid Staking Derivatives Finance) is DeFi protocols, built and operated on the Liquid Staking platform. LSDfi allows users to flexibly use assets LSD for many different purposes. Additionally, this narrative also help LSD tokens improve liquidity, increase capital efficiency and generate profits in the DeFi ecosystem.

LSDfi started to receive a lot of attention in the crypto market in early 2023 when Ethereum launched Shanghai update.

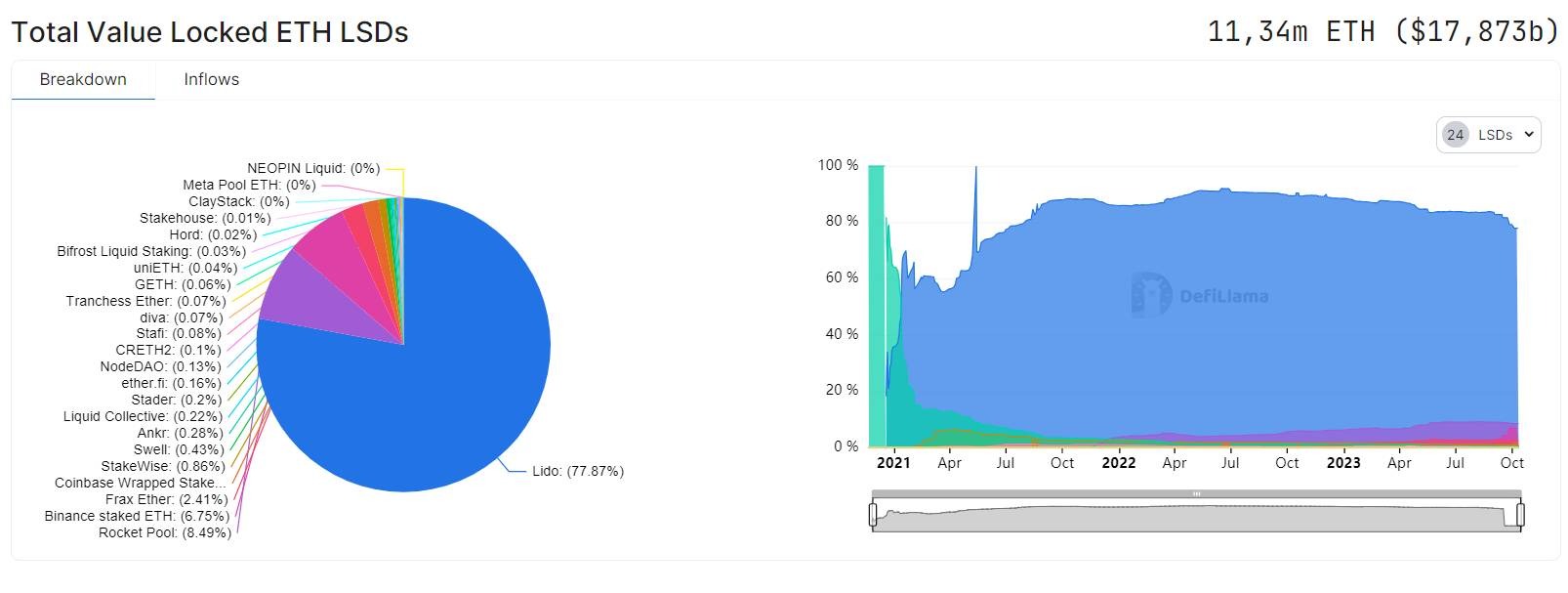

The total value of ETH staked through Liquid Staking platforms is currently 18.41 billion USD, a quite impressive number. Projects in the LSDfi segment can fully utilize TVL to create new products for the marketDeFi.

Total ETH locked in LSD protocols on October 11, 2023. Source: DefiLlama

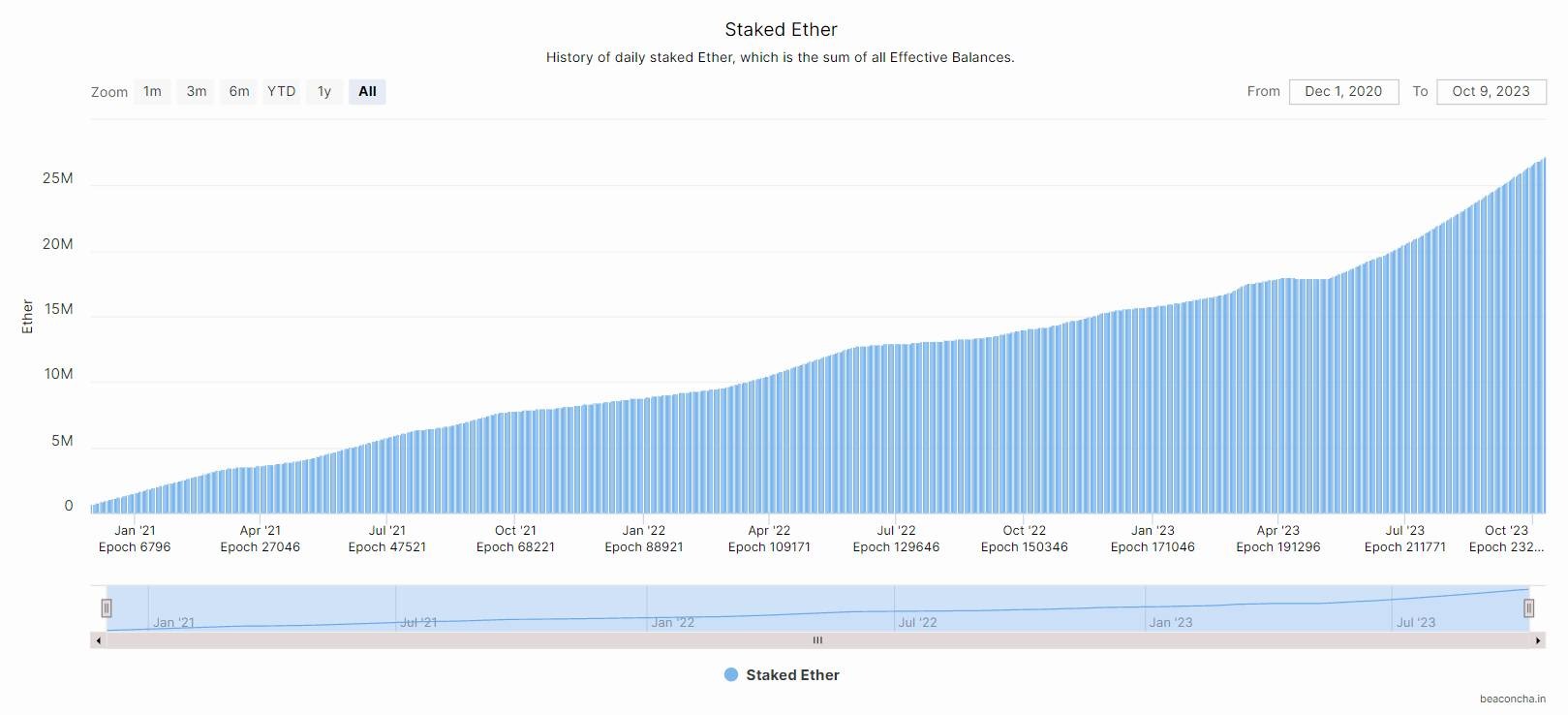

According to Beconcha.ai, only 22.52% of ETH has been staked. This number can absolutely continue to increase in the future and create more space for LSDfi projects.

Total ETH staked on the Ethereum network on October 11, 2023. Source: Beaconcha.in

From the above information, we can see that the LSDfi field still has a lot of development potential, and will likely be the market’s leading trend in Q4/2023.

RWA

Real World Asset(RWA) are real-life assets such as real estate, vehicles, precious metals, etc. that are encoded on-chain as tokens or NFTs to be used in DeFi.

This field has huge growth potential, as the RWA market accounts for the majority of global financial value. For example, the global real estate market is worth up to 326 trillion USD or the global gold market is worth 11.5 trillion USD. If a very small portion of this were tokenized and brought into DeFi, it could provide a powerful boost to the entire cryptocurrency market.

Lending platform MakerDAO is one of the pioneering projects participating in the RWA field through the form of buying US corporate bonds. Investing in the RWA field has brought quite positive results for MakerDAO when more than 50% of the entire project’s revenue comes from this form of investment.

Last July, Avalanche launched an investment fund with a value of 50 million USD in the RWA field. This event could be the first step for a wave of investment in Real World Asset in the near future.

Overall, RWA is an extremely potential field and will continue to grow strongly in the near future.

SocialFi

SocialFi is a combination of social network and decentralized finance (DeFi) features. The SocialFi platforms provide a Web3 (decentralized) solution for creating, managing and owning social media accounts and content.

Friend.tech is the most notable SocialFi project at the moment that is considered a social network web3 build on Baie. Curently, this platform has only opened a limited beta version, so users need to have an invitation code from another user to access and create an account. In addition, the social network friend.tech only supports mobile applications, but does not have a desktop version. In just a few months, friend.tech has generated revenue of up to 20 million USD.

With major KOLs in the crypto market still actively using this platform for the opportunity to receive large airdrops in the future, SocialFi will be one of the trends driving the market this Q4.

Retroactive

Retroactive is an innovative approach to token allocation in the cryptocurrency sector. Projects using this model often distribute their tokens at TGE directly to users who supported the project in the early stages of development, instead of selling to the market through Public Sale.

Currently, there are quite a few projects expected to distribute tokens in the form of Retroactive. LayerZero and zkSync are two projects that are highly likely to issue tokens in Q4/2023.

- LayerZero is an important solution in the blockchain field, helping independent blockchains to be compatible with each other while still maintaining decentralization, safety and not requiring dependence on third parties. Through 5 rounds of funding, LayerZero has raised more than 260 million USD.

- zkSync is a solutionlayer-2 belongs to the ZK-Rollups group on Ethereum, developed by the Matter Labs team with the support of many large investment funds, such as a16z, Crypto.com, Bybit,ConsenSys… zkSync has raised more than 458 million USD.

Summary

Identifying trends in the cryptocurrency market is one of the extremely important factors that help investors make profits in this potential market. However, identifying potential future trends is very difficult and requires investors to have a lot of experience. Through this article, Kretos hopes to provide you with a reference perspective on trends that can attract cash flow in Q4/2023.