It has been a year since The Merge event happened. Now, let’s look back at Ethereum after 1 year of The Merge!

Overview of the Merge

The Merge is an event that marks a turning point in the Crypto market in general and Ethereum in particular when the Ethereum network officially switches from Proof of Work to Proof of Stake. Along with that are a series of changes that are also a consequence of the above transformation, including:

- Energy consumption was reduced by 99%.

- The number of ETH minted per block also decreased by 90%, and there is a high possibility that Ethereum will enter a deflationary phase.

- Block completion time was shortened, but not significantly.

On September 15, 2022, the Merge occurred successfully without network-related problems. Ethereum officially switched from PoW to PoS.

Looking back at Ethereum after 1 year the Merge takes place

In terms of Ethereum’s price, not much may appear to have changed since last September. A day before the transition took place, ETH traded hands at around 1.600 USD —approximately the same price it’s trading at a year later.

However, under the hood and on-chain, there have been substantial developments, whether that’s a decrease in Ethereum’s overall supply or a sharp increase in the amount of Ethereum that’s staked, just to name a few.

On-chain metrics

After one year, Ethereum officially stepped from inflation to deflation. That is important for the long-term growth of ETH, even though Bitcoin is not. Because Bitcoin essentially only reduces the inflation rate each year through block rewards. Ethereum’s current deflation rate is -0.2488%.

At the time of the Merge, the total supply of ETH was 120,521,029 ETH. Now, the supply of ETH has reduced by about 980,000 ETH (equivalent to $1.47B for $1,500/ETH), reaching 120,221,737 ETH.

However, when the Ethereum network recently became gloomy, the supply of ETH is showing signs of increasing.

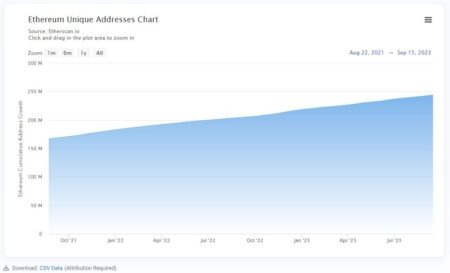

The number of transactions on the Ethereum network over the past year has not fluctuated too much, even tended to decrease slightly. Besides, the total number of new addresses on Ethereum is still increasing steadily, but we do not see a surge.

Trends created after The Merge

Perhaps the biggest trend created after the Merge is LSD and LSDFi.

Why is the Merge creating this trend?

It can be said that the Merge plays a key role in Ethereum officially becoming a PoS. For PoS platforms, the LSD industry will be extremely developed. However, we need more catalysts from Shanghai Upgrade with direct deposits and withdrawals from Beacon Chain.

Since then, the LSD trend has exploded, led by Lido Finance.

LSDfi was born to increase liquidity for LST (Liquid Staking Token). We see that each LSD platform has different LSTs such as Lido Finance – stETH, Rocket Pool – rETH, Frax Finance – sfxrETH, fxrETH, Swell – sETH, yEARN Finance – yETH… Thereby, we have an LSDfi ecosystem with a variety of puzzle pieces, such as:

- AMM: Curve Finance, Maverick Protocol, Uniswap V3…

- Lending & Borrowing: Lybra Finance, Raft…

- Layer 1: Tenet Protocol,

- Yield Farming: Pendle Finance

- Index: unshETH, Index Corp…

- Self-Repaying Loans: Alchemix, ZeroLiquid, Savvy, Cat in a Box Finance…

What’s next for Ethereum?

Cancun Upgrade is the next upgrade of Ethereum. This update has a strong impact on the entire Layer 2 market in the same way that Shanghai Upgrade impacts the LSD industry. Cancun is expected to reduce transaction fees on Layer 2 by 10 – 100 times. Basically, the transaction fee on Arbitrum is currently $0.2, then it can be reduced to $0.02 – $0.002. It can be seen that this is one of the final keys that indirectly leads Ethereum to Mass Adoption.

Currently, we have many outstanding Layer 2 projects such as:

- Arbitrum with an ecosystem focusing on Perp DEX, Gaming and Layer 3 in the long-term future.

- Optimism with an ecosystem focusing on Synthetix, AAVE and Perpetual, besides Superchain.

- Some Layer 2s are under construction such as Linea, Base, zkSync, StarkNet…

Not only that, but also, we have many updates ahead, such as:

- The Surge: This update will replace the old development roadmap Sharding to EIP-4488 with the focused technology Danksharding. The Surge also integrates zkEVM from ZkSync, Scroll, Polygon… and Rollup expansion solution with the goal of reaching 100 TPS in the future.

- The Verge: Supports validators to quickly and easily validate SNARK transaction proofs of zkRollup scaling solutions.

- The Scourge: Thoroughly handling issues related to MEV helps improve user experience on the network.

- The Splurge: Completes a number of other upgrades to make the Ethereum network smoother.

Summary

After one year, the Merge impacted the ETH economy and contributed to creating many future trends.