Like the general crypto market or the traditional stock market, the NFT market also exhibits cyclicality with periods of price increases and periods of price decreases. In this blog, let’s learn about the NFT market cycle so that everyone can have a comprehensive perspective for their investment process.

What is a Market Cycle?

Perhaps, people have all heard of market bubbles and many people have been caught in one. Although there are plenty of lessons to be learned from past bubbles, market participants still get sucked in each time a new one comes around.

A bubble is only one of several market phases, and to avoid being caught off-guard, it is essential to know what these phases are. Therefore, an understanding of how markets work and a good grasp of technical analysis can help you recognize market cycles.

Market cycles are trends that appear in different markets or financial environments. There are illustrated by rising or falling peaks and troughs as well as alternating fluctuations in sideways markets. Causes of cycles include factors such as the amount of liquidity in the economy, interest rates, technological advances and black swan events.

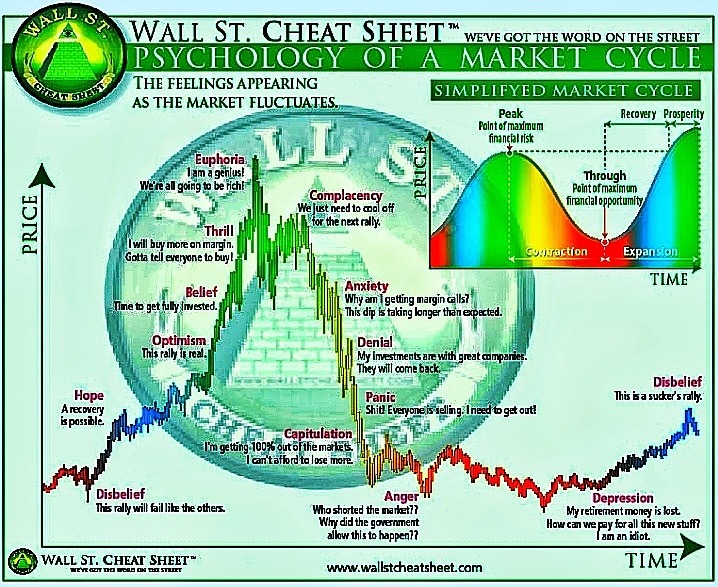

The market cycle chart – allows people to identify specific parts of the cycle based on what they believe is consistent with current market sentiment.

The market cycle chart – allows people to identify specific parts of the cycle based on what they believe is consistent with current market sentiment.

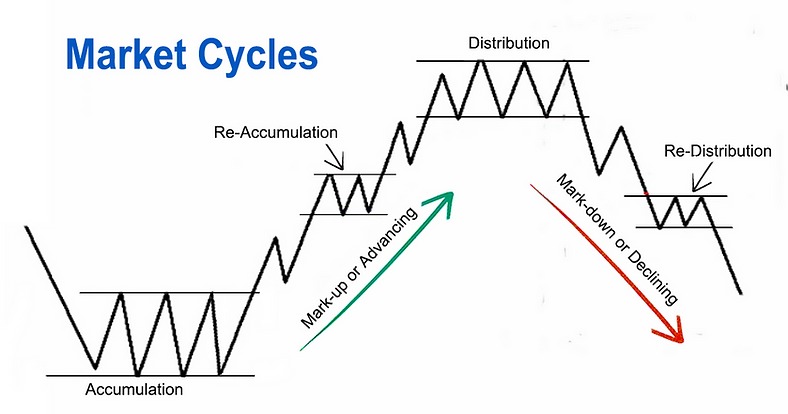

The market cycles move in four phases:

- Accumulation phase: The market has bottomed, and early adopters and contrarians see an opportunity to jump in and scoop up discounts.

- Mark-up phase: The market seems to have leveled out, and the early majority are jumping back in, while the smart money is cashing out.

- Distribution phase: Sentiment turns mixed to slightly bearish, prices are choppy, sellers prevail, and the end of the rally is near.

- Mark-down Phase: Laggards try to sell and salvage what they can, while early adopters look for signs of a bottom so they can get back in.

Although these periods are constant across different markets, they vary in frequency and length because each market has its own fundamentals.

The NFT market cycle is no exception and let’s find out together.

How Does the NFT Market Cycle Work?

Unlike crypto market which has gone through many cycles and started the growth season with Bitcoin Halving, the NFT market has only become widely known in 2021.

Therefore, let’s go back to history at the beginning of 2021 and see how the NFT market cycle works!

Popularity of the NFT market

Popularity is also a factor to evaluate market sentiment and see which stage of the market we are in. I will use two data sources: Google Trend and transaction volume on the NFT market to evaluate the market cycle.

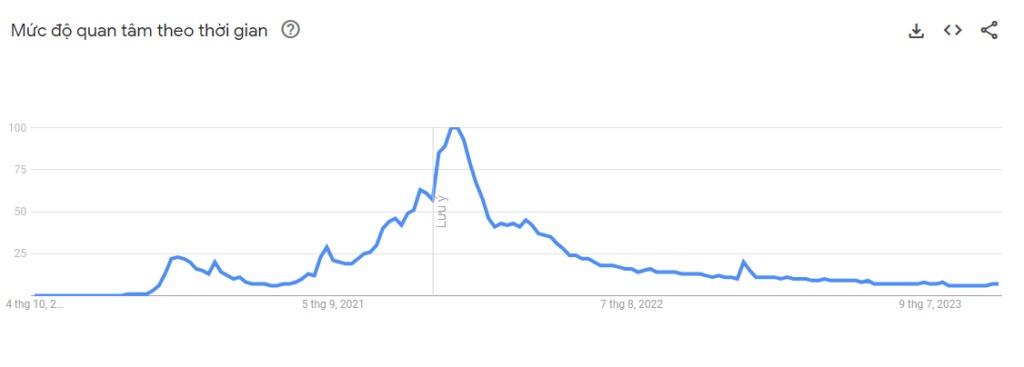

First, the Google Trend chart shows the popularity of searching NFT on Google. We can see NFTs being searched, known in early 2021 and having a small growth cycle before becoming explosive in the period from July 2021 to May 2022.

At the present time, the NFT index based on Google Trend only falls between 5-7 points, signaling that the market is in a cold winter period and there is not much interest in NFTs.  Popularity of NFTs according to Google Trends.

Popularity of NFTs according to Google Trends.

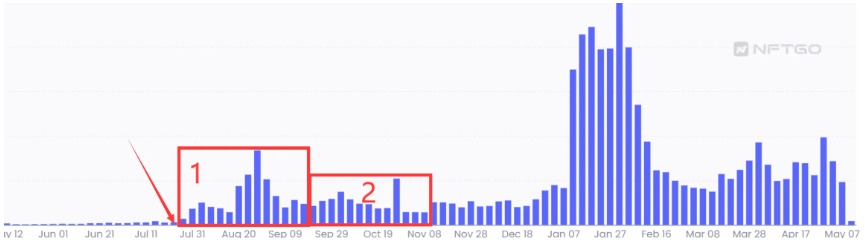

When looking at the trading volume during the uptrend market period from July 2021 to May 2022, we can clearly see the growth in trading volume, especially in the early period of 2022.

NFT trading volume between July 2021 and February 2022.

Every bull wave begins with a bullish trigger point, usually an event that attracts user discussion and attention. This is marked by 2 boxes circled in red 1 and 2 as shown above. After this period, the trading volume in the market witnessed a sudden decline, accompanied by a decrease in the price of NFT Blue-chip collections. This signals an impending major bearish trend.

Stages of development in the NFT market

Almost every trigger point is related to exaggeration. I will divide the popular sources of NFTs into two groups including: Media and community.

First, this is media that often involves works of art encoded as NFTs. In March 2021, American digital artist Beeple sold his NFT artwork called “Everydays: the first 5000 days”, with price more than 60 million USD. Immediately, this NFT attracted great interest from media in the world.

Everydays – The First 5000 days

Everydays – The First 5000 days

Due to the widespread attention of the media, other NFTs on the market also saw impressive growth. After that, celebrities such as Takashi Murakami and Snoop Dogg also entered the market. NFTs seem to have been hyped by the media, further promoting user entry into the NFT market.

The widespread popularity of Art NFT in media also created a small growth cycle, impulsed the development of the market and attractive new players. That has also been shown on the Google Trend chart in the periodrom January to March 2021.

The next period, from July 2021 to May 2022, the market officially entered a strong growth wave. The trigger point for this period was the explosion of the Play To Earn game, led by Axie Infinity. This period was also the start of one of history’s most successful collections – Bored Ape Yacht Club (BAYC).

The growth in the price of NFTs contributed to a catalyst that motivates people to share information about NFTs on social media platforms, thereby increasing the popularity of NFTs. During this period, we also saw the participation of many famous people rushing to buy NFTs, such as Elise Boucher, Ja Rule, Lewis Capaldi, etc.

After being affected by the general Crypto market, with the collapse of Luna in May 2022, the NFT market officially entered a mark-down (bearish) phase.

During mark-down phase, Fuds in the market were also appeared. We could see Fuds regarding supply dilution issues of Bored Ape Yacht Club (BAYC), the crash of Azuki after the release of Azuki Elementals or Degods with Degods Season 3.

All of them had created a fear mentality in the market, causing investors to sell off their NFTs, resulting in the price of NFTs falling further.

Money Flow in the NFT Market

Similar to the general Crypto market, there is always a flow of money back and forth between different segments in the market.

When looking at the Uptrend timing in 2020 and 2021, we start with Defi Summer 2020 → Layer 1 in the early 2021 → Trend Gamefi (the explosion of the Play To Earn game, led by Axie Infinity) → Trend Metaverse (led by The Sandbox and Decentraland) —> Trend NFT (led by BAYC and CryptoPunks).

Through a growth cycle, we see that cash flow does not stay in one segment for too long and tends to move to other segments in the market.

This is quite easy to understand, for example, the Defi trend with the token release Farm model has many disadvantages and no longer attracts the attention of users, forcing investors to move to search for profits in other segments. In another area, we can see the appearance of Trend Play To Earn with Axie Infinity as a typical example.

As for the NFT market, we also see the circulation of money through small segments. Typically, we see the market starting with Art NFT (digital artworks) being sold for millions or even more than tens of millions of dollars → NFT Gaming with the explosion of Axie Infinity → PFP NFT with the leadership of Bored Ape Yacht Club (BAYC) and CryptoPunks → Music NFT with the explosion of Sound.xyz.

In general, the market always needs innovation to develop and attract users. Therefore, during the investment process, people need to pay attention to which segments are receiving attention and receiving cash flow in the market. Choosing the right project with the trend appearing on the market helps significantly increase the profit margin that people can earn.

Compare NFT Market With Crypto Market

There are similarities and differences between the NFT market and the Crypto market.

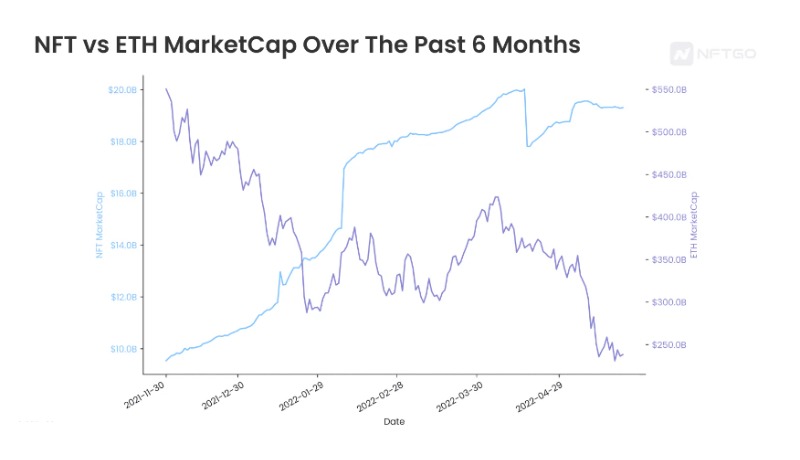

Currently, the NFT market is built on the Crypto market, so it is obvious that the NFT market is affected by the general market, although the reaction is often “slower”. As we can see in the image below, when the Ethereum market value starts to witness a steep decline, the value of the NFT market is not directly affected and decreases immediately following.

Compare the correlation between NFT and ETH market capitalization.

When market volatility occurs, the NFT market tends to react more slowly due to less liquidity. Additionally, network congestion makes gas fees expensive, which also prevents users from trading their assets. This is the reason why trading volumes are down but we don’t see that in the floor prices of NFT collectibles. Conversely, when the Crypto market has small fluctuations, the NFT market tends to perform better.

Summary

Investors’ psychology always appears in any market, so the cycle is always short or long depending on the nature of each market. Above is all the information that I want to introduce in this NFT market cycle article. I hope everyone has received useful knowledge.