Liquid Staking Derivatives (LSDs) came about after the launch of the Ethereum beacon chain on December 1, 2020, which allowed holders to stake their ETH and become validators. In return for securing the network, ETH rewards were distributed to validators. However, becoming a validator required a minimum of 32 ETH, and withdrawals were only possible starting in April 2023. To promote staking participation among smaller ETH holders and provide liquidity options, LSDs were introduced.

Liquid Staking Derivatives or Tokens (LSDs or LSTs) are tokenized representations of staked assets in a blockchain network, offering flexibility and liquidity while earning staking rewards. LSTs can be traded or used in DeFi protocols.

The operation model of Liquid Staking & LST.

The operation model of Liquid Staking & LST.

Ethereum Staking Market Landscape

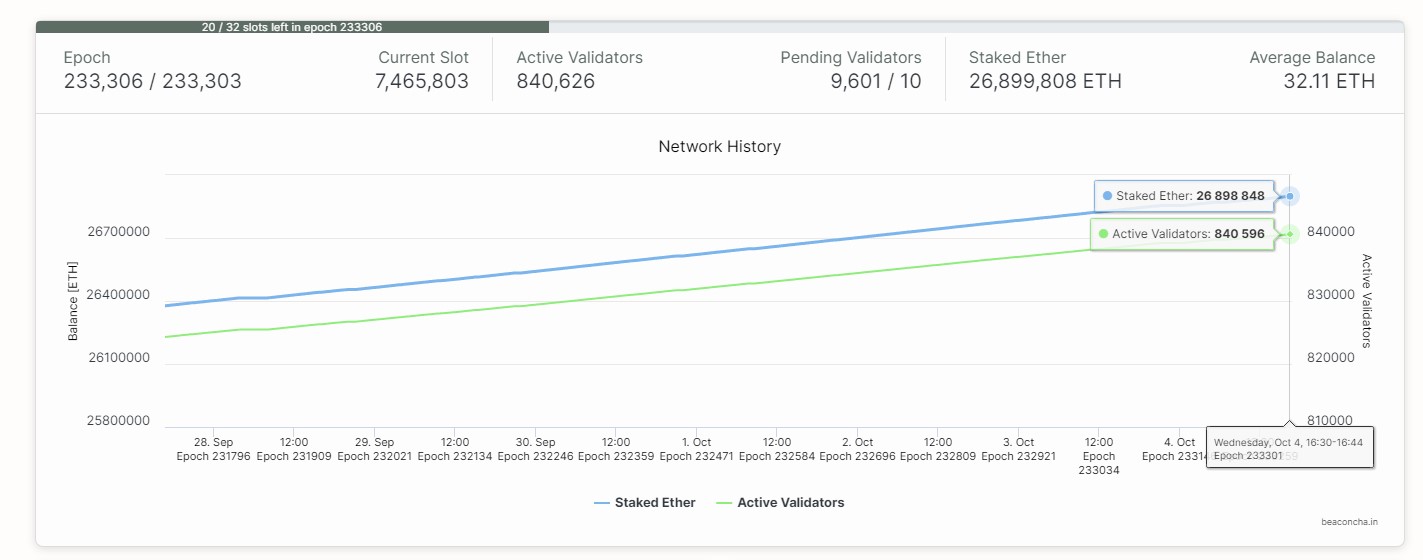

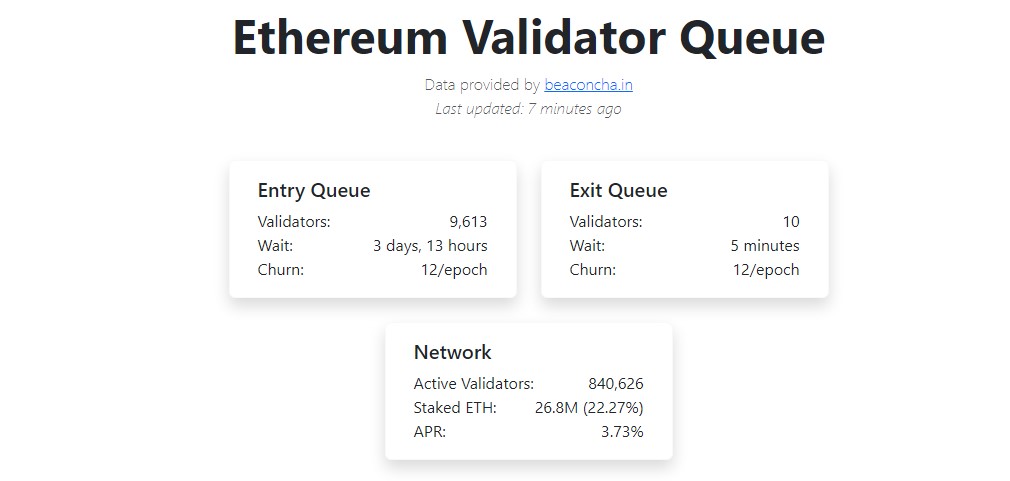

The number of active validators on Ethereum

After the Shanghai update, the number of validators on Ethereum is increasing, creating a premise for the sustainable development of the LST market.

- 3 months before Shanghai update (12/01/2023 – 12/04/2023): increasing 64,829 validator (equivalent 2,074,528 ETH staked in the Ethereum consensus model).

- 3 months after Shanghai update (12/04/2023 – 12/07/2023): increasing 97,253 validators (equivalent 3,112,096 ETH staked in the Ethereum consensus model).

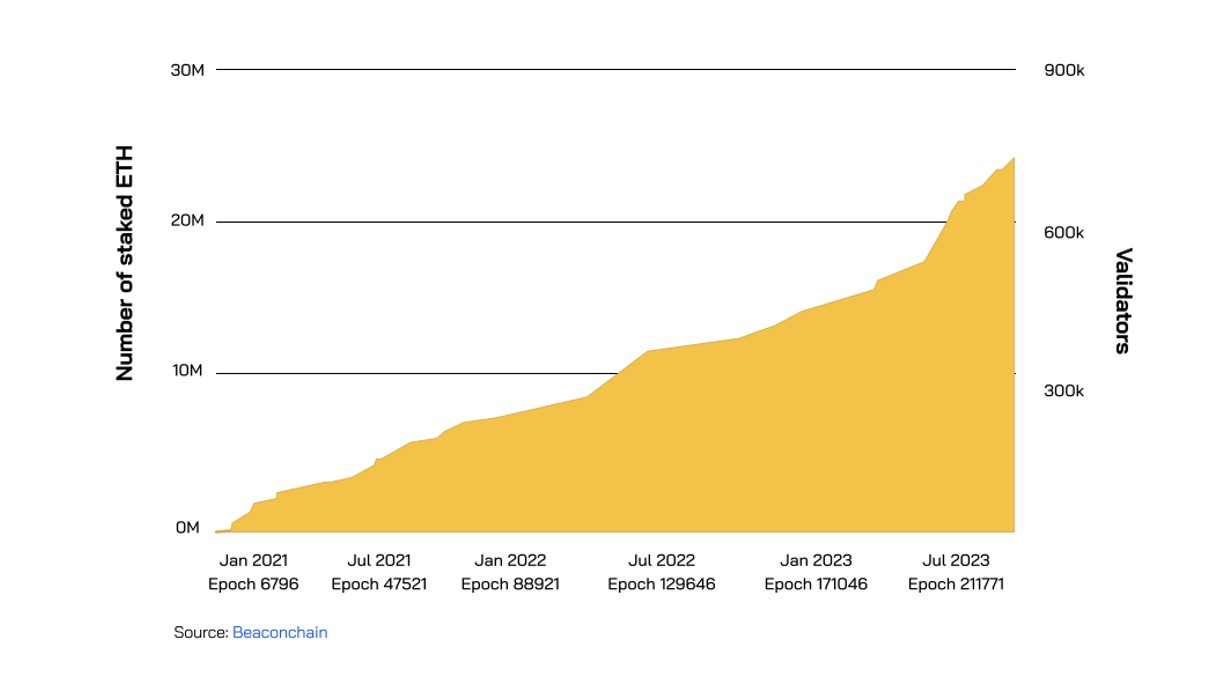

As of October 04, 2023, there are 26.9M ETH staked in the Ethereum Beacon chain (840,626 validators) that account for 19.4% of the ETH circulating supply.

The number of staked ETH and number of active validators on Ethereum. Source: Beconchain

Current landscape of the Ethereum network

Ethereum Entry Queue & Exit Queue are queuing mechanisms designed to maintain stability Ethereum consensus.

These queues include validators waiting to start staking (Entry Queue) or withdraw ETH (Exit Queue). The network will impose a rate limit on the number of validators that can be added or removed per epoch, also known as Churn.

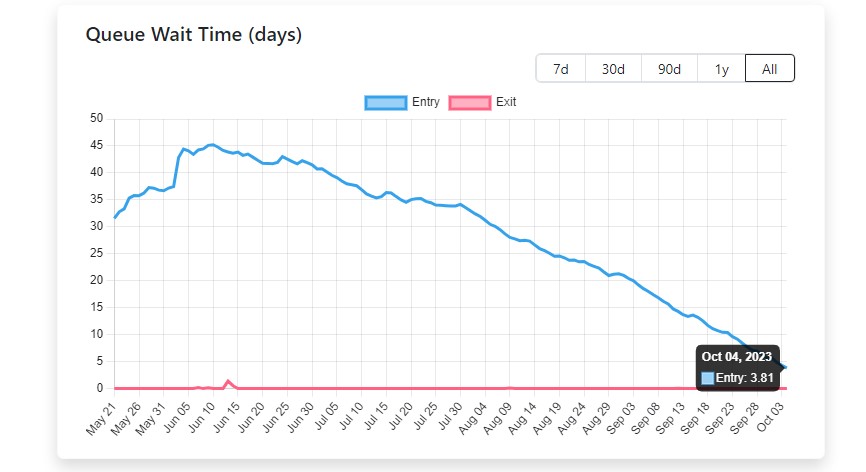

The current state of the Ethereum network. Source: Validatorqueue

While the Exit Queue is almost always available, users do not have to wait to withdraw ETH from a validator, the Entry Queue has wait times lasting weeks. This shows a high demand for jobs become Ethereum validator.

Remarkably, the Entry Queue has a clear decreasing trend. It peaked at 45 days in June and gradually decreased to 4 days at the present time.

Source: https://www.validatorqueue.com/

Source: https://www.validatorqueue.com/

In Consensus Layer Meeting 113, Dapplion (Core DEV Ethereum) predicted that if the Entry Queue operates continuously for the next 9 months, the number of Ethereum validators will increase to 2,000,000 validators.

In mid-August 2023, the Ethereum Foundation also launched the Holesky testnet with 1.4 million validators (almost twice the number of validators on mainnet) to test the implementation of code changes in the future of Ethereum.

Based on data and actions of the Ethereum Foundation, it is predicted that the number of Ethereum validators will continue to expand in Q4/2023 – Q1/2024. However, the speed will slow down significantly.

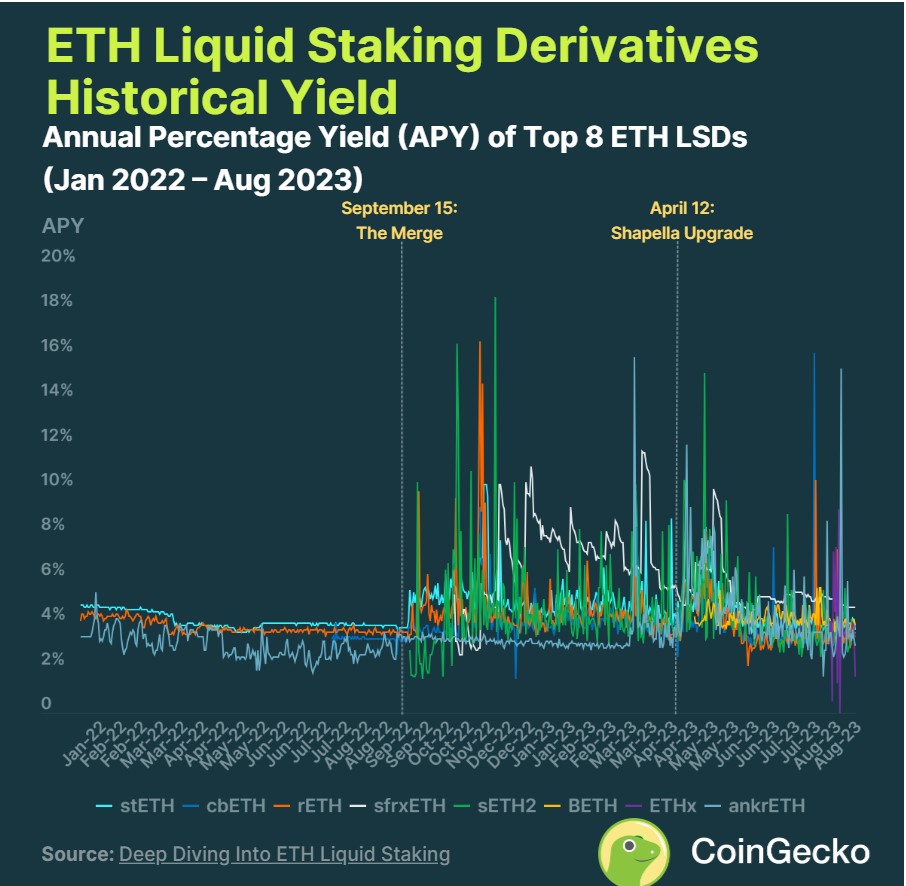

LSD yields have averaged 4.4%

The top 8 ETH LSDs have had an average yield of 4.4% Annual Percentage Yield (APY) since January 2022.

The top 8 ETH LSDs have had an average yield of 4.4% Annual Percentage Yield (APY) since January 2022.

During notable events within the crypto space (Ethereum Merge in Sep 2022, FTX collapse in Nov 2022, USDC depegging event in Mar 2023, and Shapella Upgrade in Apr 2023), yields tended to spike, reaching an all-time high of 18.2% in November 2022.

- Frax’s sfrxETH has been the best-performing LSD in terms of average yield, at 6.2% between October 2022 to August 2023

- Lido’s stETH comes in second, with an average yield of 4.6%

- Followed closely by StakeWise’s SETH2 with 4.5%

- Other LSD protocols offer yields ranging from 3.9% – 4.2%.

- Ankr’s ankrETH is an exception, offering an average yield of 3.5%, the lowest amongst LSD protocols.

As of the end of August 2023, the average yield across the Top 8 LSD protocols is at ~3.28%, with 26.4 million ETH staked. However, yield is expected to decline as the amount of ETH staked continues to increase.

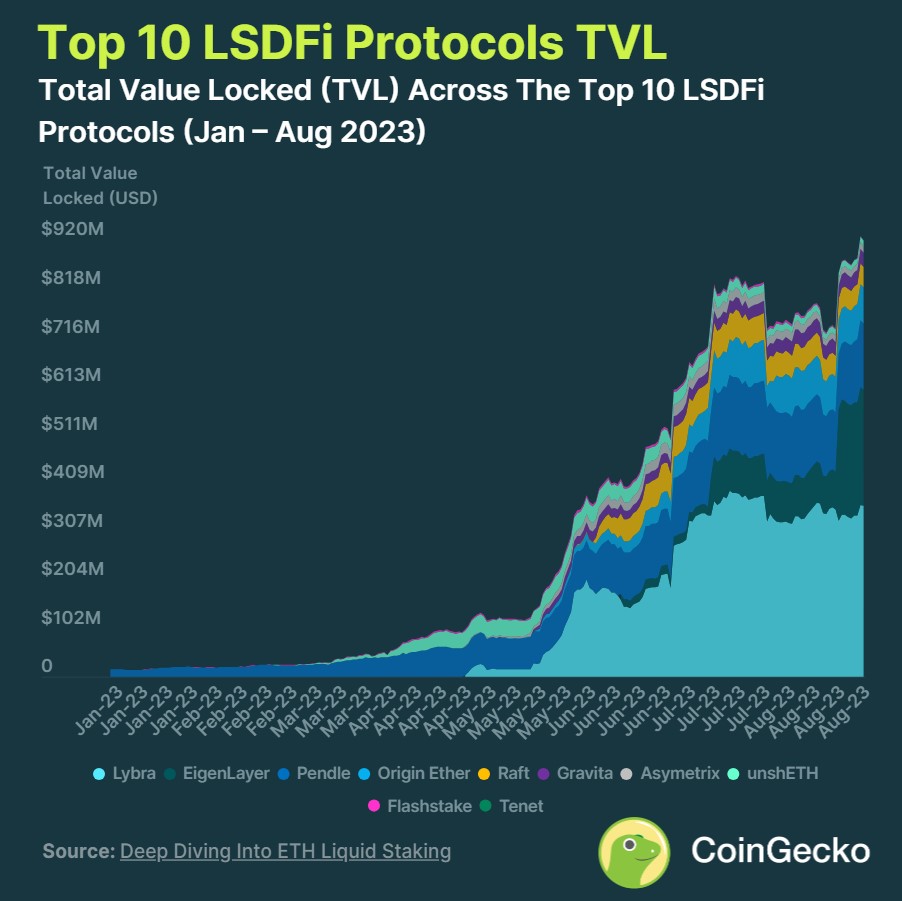

Total Value Locked (TVL) Across LSDFi Protocols

Top 10 LSD protocols by TVL. Source: CoinGecko

Top 10 LSD protocols by TVL. Source: CoinGecko

The Total Value Locked (TVL) across LSDFi protocols has grown 5,870% (58.7x) since January 2023, and has reached $919.0M on August 31, 2023.

Lybra, which was launched post-Shapella, has become the dominant LSDFi protocol, with 39.1% of TVL or $359.0M by the end of August.

EigenLayer has also benefited from the LSDFi hype and has $245.0M in TVL since its launch in June 2023. Its success could be partially attributed to users hoping for a potential airdrop.

Pendle, which was launched in 2021, experienced renewed interest amidst the surging popularity of LSDs in 2023. Its TVL rose by 903%, from $15.4M to $139.4M between January and August 2023, and is now the third largest LSDFi protocol.

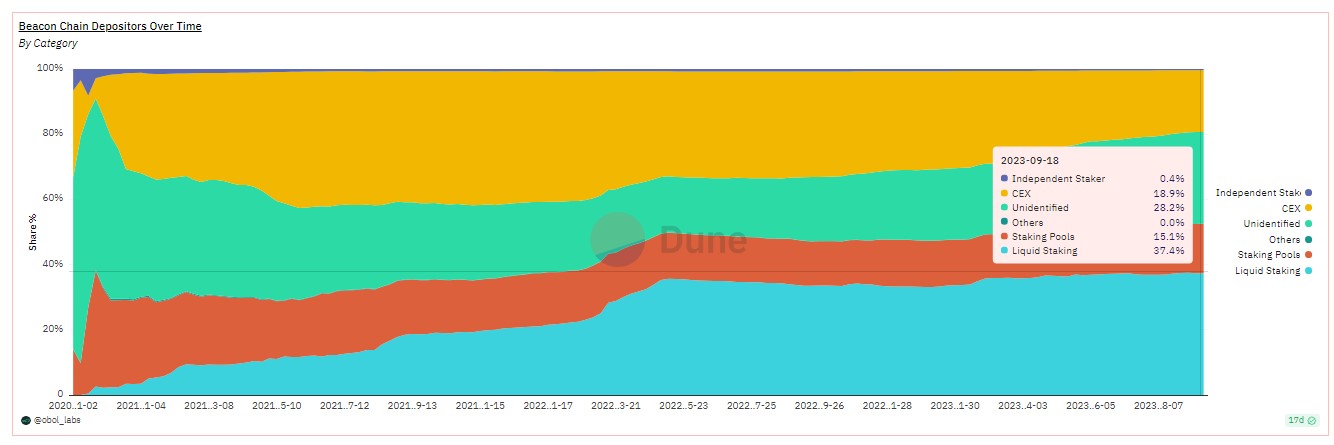

LST’s position in the Ethereum Staking market

Liquid Staking occupies an increasingly important position in the Ethereum Staking market. The Liquid Staking market share has increased steadily over the years and is currently stable at 36 – 37%.

Liquid Staking market share. Source: Dune

Lido with stETH is dominating the LST market on Ethereum and accounts for more than 76% of the market share.

In the current context, discussions on the topic of “decentralization of LST” can have a great influence on Lido, but the statistics show that Lido is still maintaining its position.

| Project | Market share | ETH staked | TVL (USD, ETH portion) | ETH staked (30d change) | ETH staked (% 30d change) |

|

Lido |

76.98% | 9,517,501 ETH | $15,763,645,932 | 703,076 |

8.0% |

|

Coinbase |

10.38% |

1,282,841 ETH | $2,124,743,948 | 73,358 |

6.1% |

|

Rocket Pool |

7.39% |

913,929 ETH | $1,513,722,324 | 51,144 |

5.9% |

|

Frax Finance |

2.10% |

260,113 ETH | $430,819,600 | 8,026 |

3.2% |

|

Stakewise |

0.70% |

86,368 ETH | $143,049,591 | 1,760 |

2.1% |

Except for Lido, the four most prominent Liquid Staking protocols on the market are based on LST capitalization, respectively, Coinbase (cbETH), Rocket Pool (rETH), Frax Finance (frxETH), and StakeWise (sETH). These four protocols account for more than 21% of the market share.

Among the four protocols, Rocket Pool (rETH) and Frax Finance (frxETH) have a noticeable growth in terms of market share:

- Rocket Pool takes advantage of the “decentralized LST” story through the Reward-Bearing model.

- Frax Finance chose to approach to maximize the profits of participants with Frax AMO and the Curve Wars strategy.

The main use case of LST

In the context of Ethereum, Liquid Staking Token (LST) refers to tokens that represent a user’s staked ETH in Ethereum’s PoS consensus model.

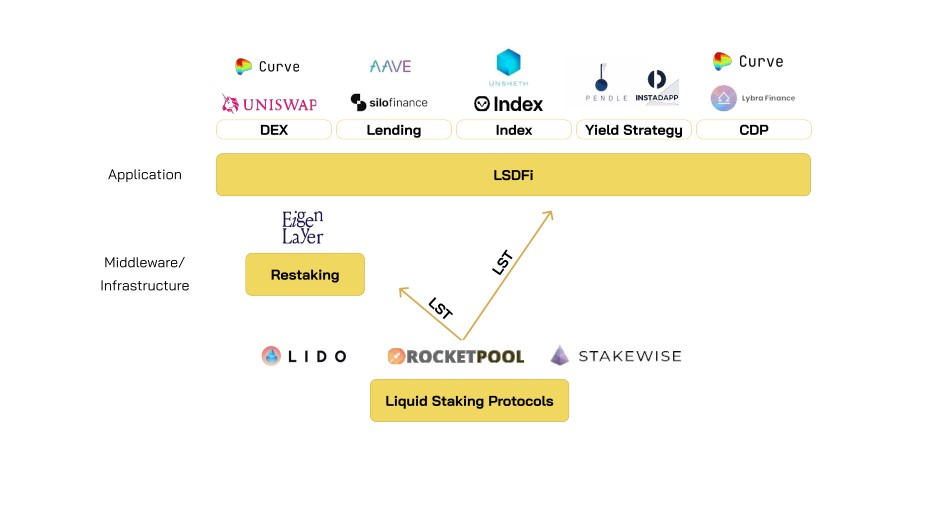

The two main use case of LST in crypto is the application layer (LSTfi) and the infrastructure/Middleware layer (Restaking).

Restaking: Use LST in infrastructure and middleware

EigenLayer

Eigenlayer is an infrastructure solution specializing in security, providing a permissionless framework that allows anyone to participate in the project’s restaking process.

Restaking is a mechanism to overcome the limitations of Ethereum, acting as a bridge that allows the Intermediate Infrastructure and Intermediate Software to take advantage of Ethereum’s Trust Model (Trust Model).

This approach not only increases the security of protocols in the infrastructure and intermediate service but also enhances the ability to use and profit from the ETH Stake in Ethereum’s consensus model.

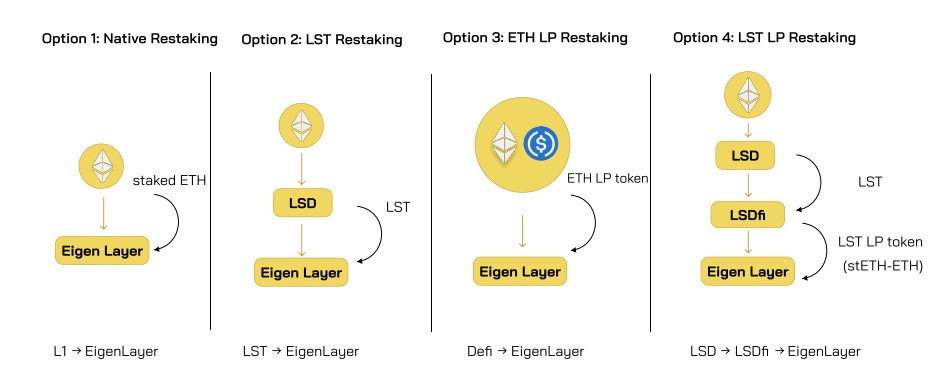

Currently, restaking the LST is one of the four strategies of Eigenlayer.

The four restaking strategies of EigenLayer. Source: EigenLayer

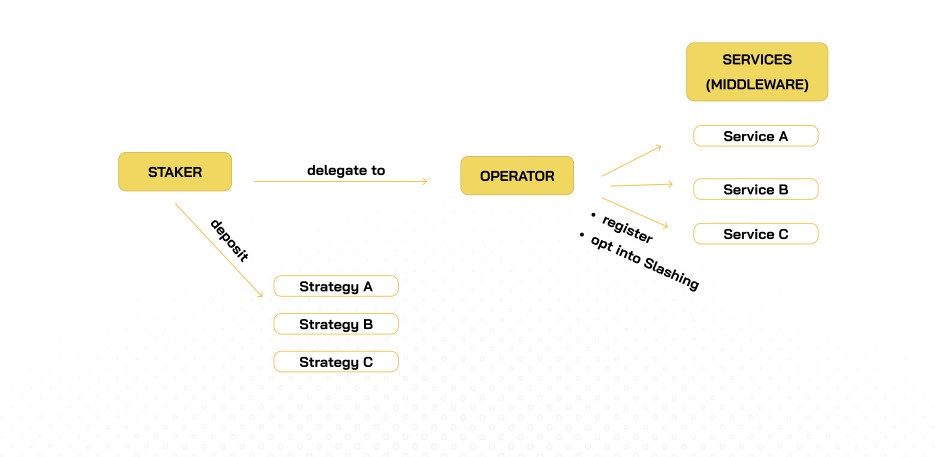

There are currently three main roles in the system of Eigenlayer: Staker, ervices supplier and Operator.

In this model, Staker can choose and authorize their tokens for an Operator. The operator will select a service to accumulate more profits and re-divide it among the stakeholders, including the Operator, Staker, and Eigenlayer itself.

Operating model of EigenLayer.

Operating model of EigenLayer.

Staker should consider choosing an appropriate operator because the risk records of both are linked together, leading to a significant increase in slashing risk when the Operator chooses to participate in many services.

Currently, the framework is in the initial development stage, no Services Supplier or Operator operates on the Mainnet. What users can do is send LST (Steth, CBeth, and Reth) or Staked ETH to Eigenlayer.

Eigenlayer TVL has reached the load limit set by Eigenlayer.

LSTFi: Use LST in application

LSTFi refers to the trend of using LST in different DeFi projects to increase the efficiency of capital use as well as additional profits.

LSTFi projects are focusing on 5 main areas: DEX, CDP, Lending, Yield Strategy, and Index.

DEX

Four LSTs have the highest liquidity on the market including stETH (LIDO), rETH (Rocket Pool), frxETH (Frax Finance), and cbETH (Coinbase).

The liquidity of the four above LSTs concentrates on the four main dexes on the market: Curve, Uniswap V3, Balancer, and Maverick.

- The curve is at the top of the total number of TVL.

- The second is balancer with the strategy focused on the LSTs. Statistical data shows that this strategy is effective because it has attracted a large amount of liquidity for the project.

|

LST/AMM DEX |

Curve | Uniswap V3 | Maverick |

Balancer |

|

StETH |

101,335 |

1,171 | 2,360 |

41,640 |

|

Reth |

867 |

1,309 | 95.1 |

27,390 |

|

FrxETH |

65,950 |

1,342 | 1.3 |

13,550 |

|

CbETH |

1,505 |

1,205 | 21.9 |

2,922 |

|

Sum |

169,657 |

5,027 | 2,478 |

85,502 |

The average 30-day trading volume of LST on AMM DEX is fluctuating at 300 – 850 million USD. The large market share of the mass concentrated mainly in the hands of Uniswap and Curve, followed by Balancer and Maverick, respectively.

CDP – Collateralized Debt Protocol

The project group allows users to use LST as collateral (Collateral) to release the stablecoin of each project. Based on the capitalization of Stablecoin, the top four CDP projects include Lybra, Curve, Raft, and Gravita.

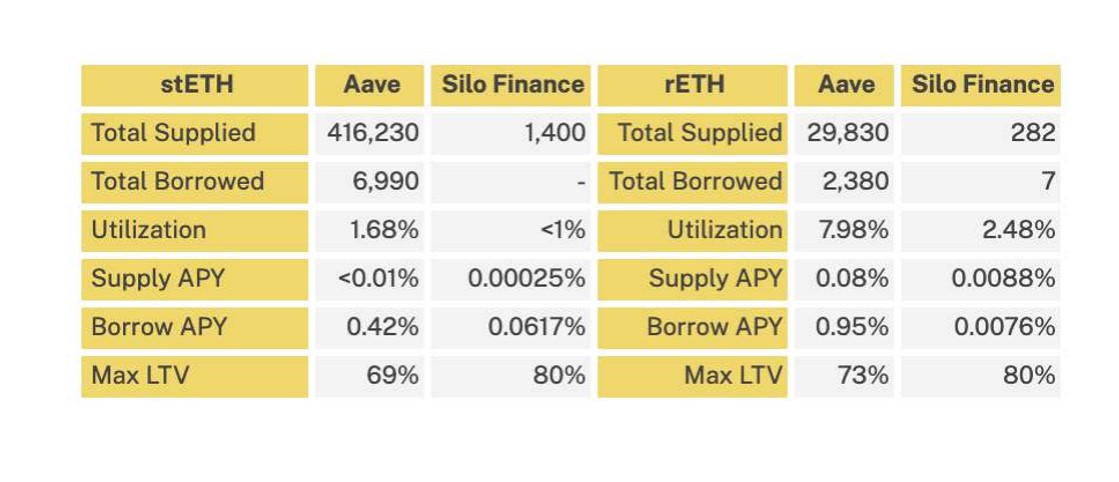

Lending

The project group allows the use of LST as collateral and helps users earn more Yield for lending activities. This project is dominated by large protocols, typically AAVE and Silo Finance.

Yield Strategy

Yield Strategy mentioned the project group to make additional profits through the use of LST, or simply help users to control and prevent risks (Hedge) for the Yield will receive. There are 2 main tactical groups:

- Leverage Strategy: Use LST in combination with lending protocols, continue to borrow ETH and Stake ETH. Projects that provide this strategy help users optimize time, gas fees, leverage control, liquidation threshold … in return, the project will take a portion of the user’s profit to charge.

- Fixed Yield: Using the capital and interest split model, whereby users will receive Principal Token (PT) & Yield Token (YT). These tokens can be traded directly in the secondary market with discounted prices, PT buyers can Redeem the original assets when matured and receive fixed income levels.

Some notable projects in this area include Pendle, Instadapp, Silo Finance, Flashtake, and Cian.

Conclusion

The world of LSDs is still in its relative infancy but has shown the potential to revolutionize staking in the Ethereum ecosystem. With continuous innovations and upgrades in the offing, the future looks promising for Liquid Staking Derivatives.