For over a decade, Bitcoin has reigned supreme as the most well-known and traded cryptocurrency. From a mere concept in a whitepaper in 2008 to its valuation in 2021 hovering over a staggering approximately $69,000 per coin, Bitcoin’s trajectory is nothing short of an economic odyssey. As we stand on the cusp of 2024, a seismic event lurks around the corner – the Bitcoin halving. The anticipation is palpable, as each halving has historically heralded massive shifts in the crypto economy.

What is the bitcoin halving?

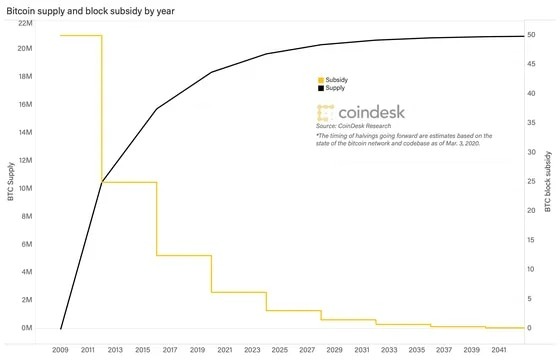

New bitcoins enter circulation as block rewards, produced by the efforts of “miners” who use expensive electronic equipment to earn, or “mine,” them.

Roughly every four years, the total number of bitcoin that miners can potentially win is halved.

In 2009, the system rewarded successful miners with 50 bitcoin every 10 minutes. Three halvings later, 6.25 bitcoins are being dispensed every 10 minutes.

The process will end once the number of bitcoin in circulation reaches 21 million. A popular estimate is that it will occur sometime near the year 2140.

Bitcoin Halving: The Basics

Every 210,000 blocks mined, or roughly every four years, the Bitcoin network experiences a halving event. The mining rewards, the lifeblood of Bitcoin miners across the globe, are cut in half, simultaneously decreasing the rate of new Bitcoin supply.

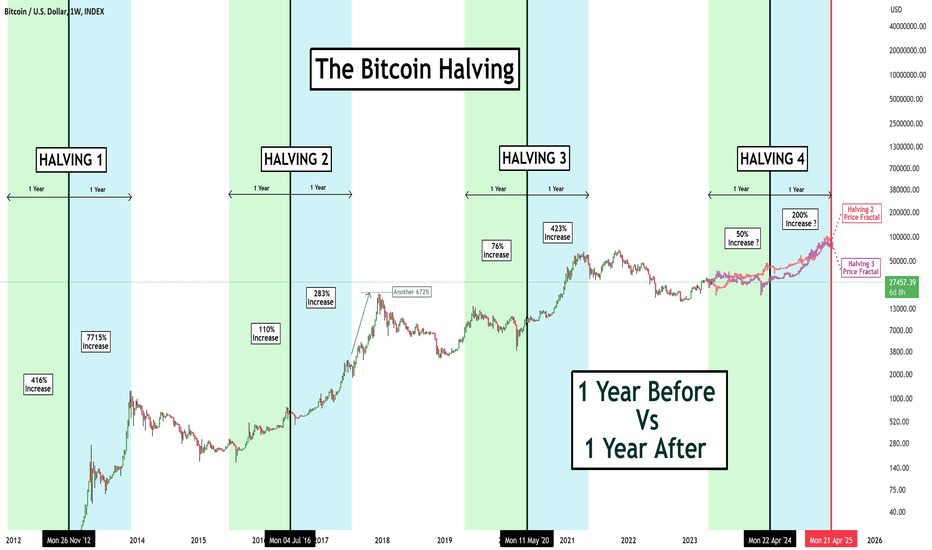

Like a ticking metronome, Bitcoin has dutifully undergone three halvings: in 2012, 2016, and 2020. Each of these instances triggered a veritable economic spectacle. Following the 2012 halving, Bitcoin’s price skyrocketed from around 12 USD to over 1.100 USD within a year. The 2016 halving bore witness to Bitcoin’s price soaring from 650 USD to nearly 20.000 USD in 2017. Most recently, the 2020 halving preceded the coin’s meteoric rise to almost 69.000 USD in 2021.

How does halving influence bitcoin’s price?

A bitcoin halving grabs so much attention mostly because many believe it will lead to a price increase. The truth is, no one knows what’s going to happen.

Bitcoin has seen three halvings so far, which we can look to as precedents.

The 2012 halving provided the first demonstration of how markets would respond to Nakamoto’s unorthodox supply schedule. Until then, the Bitcoin community didn’t know how a sudden decline in rewards would affect the network. As it turned out, the price began to rise shortly after the halving.

The second halving in 2016 was highly anticipated. On July 16, 2016, the day of the second halving, the price dropped by 10 percent to $610, but then shot back up to where it was before.

Although the immediate impact on the price of bitcoin was small, the market did eventually respond over the course of the year following the second halving. Some argue that the increase was a delayed result of the halving. The theory is that when the supply of bitcoin declines, the demand for bitcoin will stay the same, pushing the price up. Looking at bitcoin’s price 365 days after the second halving, we can see it rose by 284% to 2.506 USD.

Looking at the most recent halving, we can also see bitcoin’s price continued to perform bullishly a full year after the event took place. This time, it rose by more than 559%.

Hunger Games 2024: The Bitcoin Edition

2024 promises another rendezvous with this economic jamboree. Bitcoin miners are bracing for their rewards to be whittled down from 6,25 to 3,125 Bitcoin.

Predicting the precise impact of the upcoming halving is akin to reading the future from tea leaves. Yet, the lessons of history suggest a reduction in supply, against the backdrop of rising or steady demand, could set the stage for another bull run. As always, various external factors, including regulatory shifts and technological advances, could twist the plot in unpredictable ways.

The Butterfly Effect: How Bitcoin Halving Impacts the Crypto Market

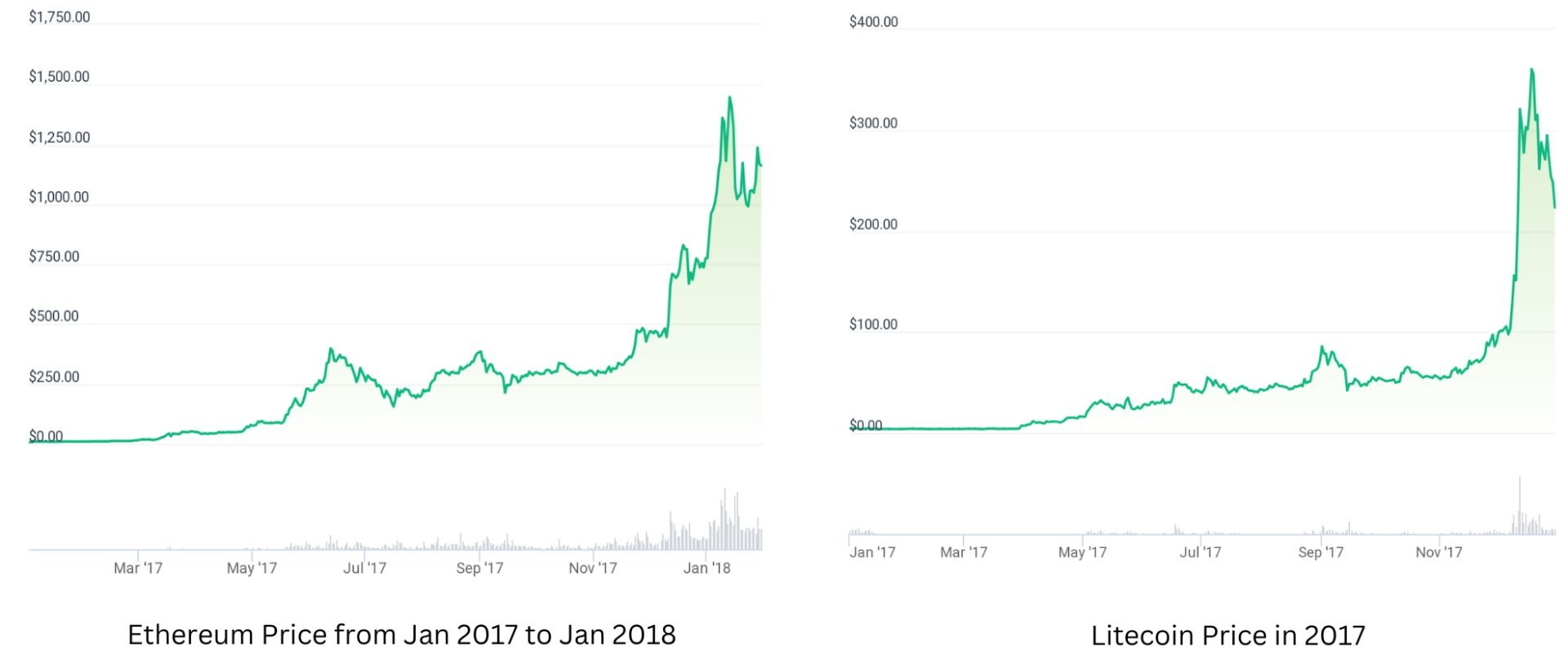

Bitcoin’s influence extends far beyond its own market. It serves as a flagship for the whole fleet of cryptocurrencies, guiding the course of the vast ocean of digital assets. As we’ve seen in previous halvings, the ripples caused by Bitcoin often result in waves across the broader crypto market.

Historically, altcoins have demonstrated a tendency to shadow Bitcoin’s price trajectory in the aftermath of a halving. Following the 2016 halving, for instance, Ethereum’s price soared from about $8 at the beginning of 2017 to a peak of approximately 1.448 USD by January 2018, representing a stunning 18.100% increase. Similarly, Litecoin, which launched as the silver to Bitcoin’s gold, grew from around 4 USD in January 2017 to over 360 USD in December 2017, marking an incredible 9.000% rise.

Trading Tactics for the Crypto-savvy Investor

One might be wondering how best to navigate the turbulent waters of the Bitcoin market in light of the upcoming halving. With careful strategy and judicious decision-making, the halving can be more of an opportunity than a risk.

Keeping a close watch on the market is important as the Bitcoin halving approaches, as prices could rise. Remember, Bitcoin’s value isn’t isolated and can be affected by a range of factors like economic conditions and regulatory news. Your strategy should align with your goals; long-term holders might buy before the halving, while short-term traders could leverage the volatility. Always manage your risk, only invest what you’re prepared to lose, and stay updated with the latest Bitcoin news.